MAURITIUS ISLAND - PRESENTATION OF THE LAWS Category General News

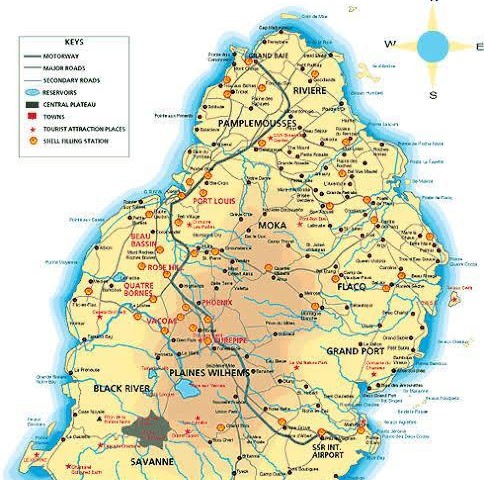

Landmass: 1,815 km2 Population: 1.2 million French and English-speaking country TripAdvisor travellers' 8th favourite island 2 to 4 hours' time difference with Europe & South Africa Purchasers can apply for permanent residence Full ownership right and property deeds in accordance with local legislation No capital gain tax and no succession duties (subject to certain conditions) Flat rate income and corporate tax - 15% Ranked 25th (out of 190 Countries!), by The World Bank in 2018 for ease of doing business Mauritius is located in the warm waters of the Indian Ocean, just off the coast of Africa. The island entices visitors with its combination of idyllic beaches, warm waters and spectacular scenery. The island offers captivating culture and history, lively markets, and a diverse array of sports and adventure activities, making it an all-round holiday destination. Formed mostly by volcanic eruptions, Mauritius is almost surrounded by coral reefs, providing significant locations for snorkelers and divers to explore the magnificent wonders of the ocean.

Mauritius have acquired a couple new developments, tailored for tranquil, sophisticated, coastal living all along the Mauritius coast. Investment companies have curated beautiful, elegant costal estates for your enjoyment. While living in the modern and chic apartments, villas or penthouses you get to enjoy the privileges of the Mauritian lifestyle and agriculture.

It has taken less than a year, but the Mauritian government has now amended the island's Non-Citizens (Property Restriction) Act to make it possible for property investors from South Africa and elsewhere to buy apartments outside of the IRS, RES and PDS developments, that were specifically designated for foreign buyers. In addition the Government has specified that the minimum investment amount has been dropped to MUR6 million, the equivalent of +/- R2.55 million at current exchange rates. Foreign buyers will still need to be registered with the Mauritian Board of Investment (BOI) and obtain a security clearance, but after that they will be allowed to buy apartments in any building or development that is more than two stories high (Ground + 2 Levels) and not built on the 'Pas Geometrique' (leasehold) land that makes up most of the island's coastal front line. They will not need an occupation permit, residence permit, or permanent residence permit to buy an apartment, and in fact, they will be allowed to acquire several apartments as buy-to-let investments if they wish and rent them out to holidaymakers or longer-term tenants. This type of investment will not come with an automatic right of permanent residence in Mauritius, but it does open up a fairly inexpensive avenue of offshore diversification for South Africans, whom have shown themselves to be very keen to own property on Mauritius. The measure of the high demand is indicated by the fact that in the past year South African investors and other Foreign Nationals have invested the equivalent of more than R2.6 billion on upmarket villas in the IRS, RES and PDS developments. But the fact is that these schemes are too expensive for many aspiring buyers.

Mauritian banks will make mortgage loans available to foreign investors, currently at interest rates of between 7% and 9% (in MUR), although the qualification criteria are stringent and borrowers will usually be expected to finance at least 40% of the purchase price themselves. South African individuals over the age of 18 have a foreign investment allowance of R10 million a year, provided they have a tax clearance certificate from SARS and the transfer of funds is approved by the South African Reserve Bank.

Mauritius is currently perhaps the leading African property market for foreign investors. This rise in interest is largely down to a relaxing of the laws relating to buying property on the island, and the government has reported a significant rise in the number of foreign investors, notably South Africans. But these investors are not just buying properties on Mauritius' outstanding coastline, they are also buying residency.

The purchase of a residential unit acquired under schemes approved and managed by the Economic Development Board - the Property Development Scheme (PDS), the Integrated Resort Scheme (IRS) and Residential Estate Scheme (RES) - offers the right to residency in Mauritius to a purchaser and their family, provided that the residential unit's purchase price is above USD 500,000.

Owners may rent out the property, become tax resident in Mauritius and face no restriction on the repatriation of funds or revenue raised from the sale or renting of the property. Mauritius has no capital gains tax, dividends or inheritance tax and a universal tax rate of 15%.

Citizens of countries that are politically or economically unstable often wish to emigrate or take out an alternative residency or citizenship as an insurance policy if things at home take a turn for the worse. If these citizens have money to invest then it makes sense to do so in countries like Mauritius that will give them some form of official status in return.

So whether you are just thinking of buying a second home in a holiday destination in the Indian Ocean or you are looking to obtain a Mauritian residency permit (RP) as a 'contingency plan', Mauritius is an excellent option to consider.

IRS scheme - The IRS was introduced by the government of Mauritius in 2002 to open the property market to foreign buyers on a restricted basis and thereby encourage the construction and sale of high-end residential and resort property in designated locations.

Non-citizens of Mauritius automatically become eligible to an RP if they acquire a property situated in an IRS with a minimum investment of USD500,000. The property owner and their family are able to reside in Mauritius for as long as the property is held. IRS villas are often attached to leisure and recreational facilities such as golf courses, marinas or gym & wellness centres. To date, the average cost of an IRS residence in Mauritius has been in excess of USD1.5 million.

RES scheme - The RES is essentially a slimmed down version of the IRS that is designed to enable landowners to undertake property development on a smaller scale (not exceeding 10 hectares). There is no restriction on the minimum price for acquiring a property under the RES, so an RES property will often be more affordable than IRS property. In cases where an RES property purchase price exceeds USD500,000, or its equivalent in any freely convertible foreign currency, the property owner and their family will be eligible to apply for an RP for as long as the property is held.

PDS scheme - The PDS scheme, which has now replaced the IRS and RES for all new developments, allows the development of a mix of residences for sale to non-citizens, citizens and members of the Mauritian Diaspora. The PDS is an integrated project with social dimensions for the benefit of the neighbouring community and allows for the development and sale of high standard residential units mainly to foreigners. Under the new PDS Guidelines, at least 25% of the residential properties developed under PDS must be sold to Mauritians and members of the Mauritian Diaspora. A foreign buyer purchasing a villa under the PDS scheme for more than USD500,000, or its equivalent in any freely convertible foreign currency, will be eligible for an RP for as long as the property is held.

Author: Bob Eedes